Heartland Flats

Institutional Multifamily Development | Northwest Lincoln, NE

CR Capital Role: Preferred Equity Partner

Overview

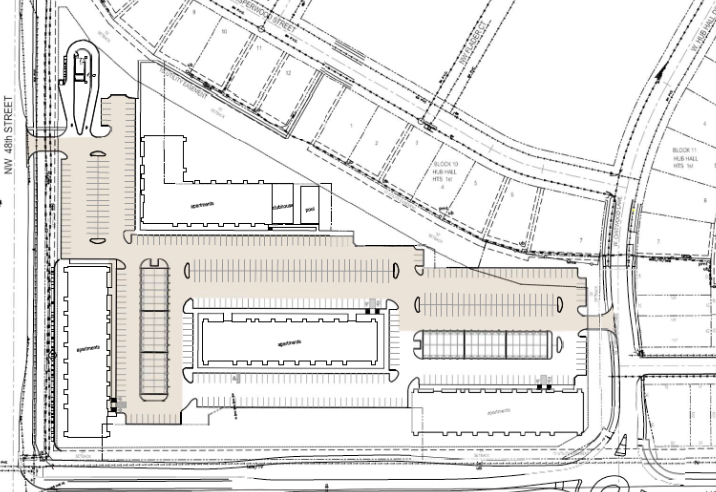

The Heartland Flats development represents a high-quality, purpose-built multifamily community in the fast-growing northwest corridor of Lincoln, Nebraska.

The project consists of four Class A residential buildings totaling 289 units across studio, one-bedroom, and two-bedroom layouts — with resort-style amenities including a pool, clubhouse, fitness facility, and detached garages.

CR Capital participated as a preferred equity partner, providing structured capital to bridge the project through development and lease-up while aligning with an experienced sponsor and management team. This investment fits squarely within CR Capital’s strategy of deploying flexible capital across income-producing and value-add real estate assets.

Project Details

Total Units 289

Structure Preferred Equity

Building Size 236,000+ Rentable SF

Developer REV Development

Property Manager Havenview Res. Communities

Project Cost $55 Million

Hold Period 7 Years

Equity Multiple 3.65–4.0x (Projected)

Target IRR 22-24%

Status Under Construction / Lease-Up

Investment Highlights

Strategic Growth Corridor: Located in northwest Lincoln near major employers such as Kawasaki, Duncan Aviation, and University of Nebraska–Lincoln.

Class A Multifamily Product: High-end finishes, in-unit laundry, granite counters, stainless steel appliances, and modern open layouts.

Experienced Development Team: REV Development’s track record includes $400M+ in completed commercial projects and $300M+ in active development.

Strong Property Management: Havenview Residential Communities manages over 2,000 units across Nebraska, specializing in new construction lease-ups and long-term stabilization.

Favorable Market Dynamics: Steady 1% annual population growth and strong household incomes ($80,000 median) support absorption and rent growth.

CR Capital’s Role

CR Capital structured a preferred equity position to help accelerate project delivery while maintaining downside protection and priority return features.

This capital solution provided flexibility for the sponsor to:

Reduce blended cost of capital relative to common equity.

Maintain project momentum without institutional red tape.

Align incentives through structured profit participation.

Strengthen capitalization with mid-stack capital that bridges traditional lending and sponsor equity.

This investment demonstrates CR Capital’s ability to provide strategic, risk-adjusted equity in partnership with proven operators executing institutional-grade multifamily projects.

Key Highlights

Class A multifamily community in Lincoln’s growth corridor

Preferred equity position with defined yield and downside protection

Proven sponsor with deep Midwest track record

Amenity-rich design with strong demand drivers

Aligns with CR Capital’s hybrid capital and income strategies

Interested in learning more about CR Capital’s preferred equity programs and hybrid fund strategy?

Contact us to schedule a call.